Picture standing at the door of your own home in 2025, keys in hand, without that familiar knot in your stomach about monthly payments. Sounds far-fetched? It’s not. This year, more homebuyers are cracking the code of affordability with one simple tool: the Home Loan EMI Calculator.

Here’s the thing. Buying a house isn’t just about finding the right location or floor plan. It’s about knowing, with confidence, what you can afford every single month. And in 2025, when interest rates are relatively stable and banks are competing hard for borrowers, that clarity matters more than ever.

Why a Home Loan EMI Calculator Matters in 2025

Not long ago, people depended on bank agents, rough estimates, or Excel sheets that barely made sense. Today, an EMI calculator gives you answers in seconds.

You enter three details: loan amount, interest rate, and tenure. Instantly, you see your monthly EMI, total interest, and the full repayment picture. No surprises later.

In 2025, this is especially useful because even small rate differences can change your EMI by thousands of rupees. With the RBI repo rate holding steady, many banks have adjusted their lending rates. A calculator helps you spot those savings before you sign anything.

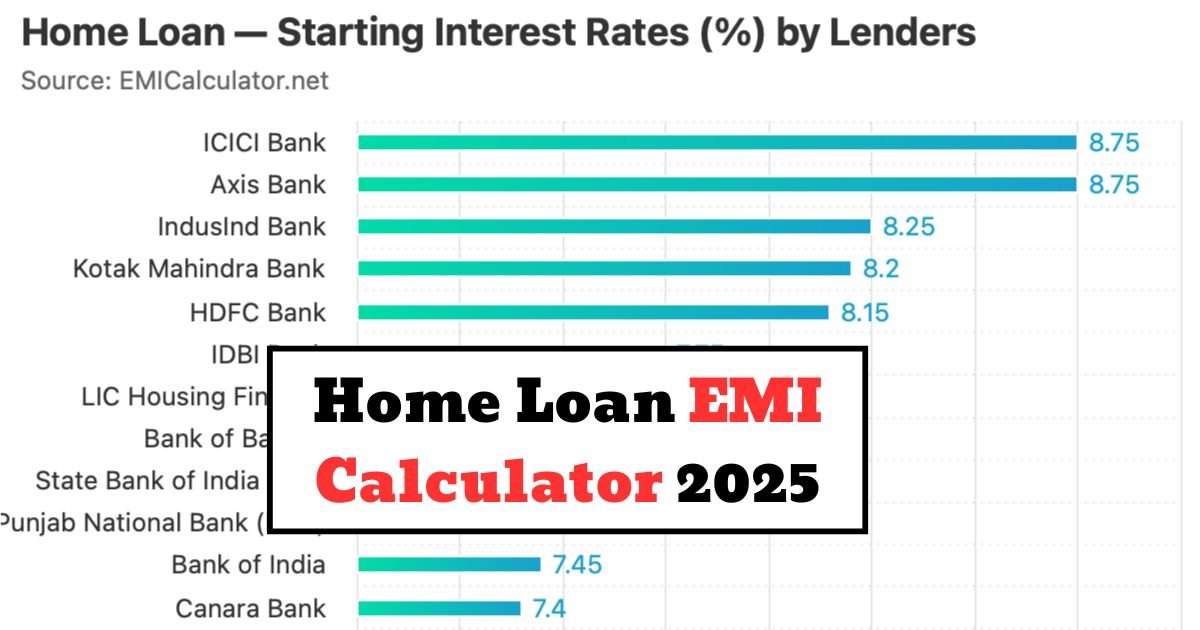

Home Loan Interest Rates in December 2025

Interest rates are the real game-changer. Lower rates mean lighter EMIs and better breathing room for your budget.

As of December 2025, public sector banks are offering starting rates around 7.35 percent per year, while private lenders are close behind. The exact rate you get still depends on factors like your income, job stability, and credit score.

This is where a Home Loan EMI Calculator shines. Instead of guessing, you can plug in different rates and see how each lender affects your monthly outflow. I’ve seen people change banks simply because the calculator revealed a long-term saving they hadn’t noticed before.

How to Use a Home Loan EMI Calculator Without Stress

Using one is simpler than ordering food online.

First, enter the loan amount you plan to borrow. For example, 50 lakh rupees.

Next, add the interest rate offered by your bank.

Then choose a tenure, anywhere from 10 to 30 years.

Click calculate.

That’s it. You’ll instantly know your EMI and how much interest you’ll pay over time.

Simple Ways to Reduce Your EMI

The calculator doesn’t just show numbers. It helps you make smarter choices.

A higher down payment reduces your loan and your stress.

A credit score above 750 can unlock lower interest rates.

Longer tenures reduce EMI but increase total interest, so balance wisely.

If rates fall later, a balance transfer could save you a surprising amount.

I’ve seen buyers save several lakhs just by testing these options before applying.

More Than a Tool, It’s a Planning Partner

A Home Loan EMI Calculator isn’t about math alone. It’s about peace of mind. In 2025’s confident housing market, it helps you buy with your eyes open, not crossed fingers.

Frequently Asked Questions

What is a Home Loan EMI Calculator?

A Home Loan EMI Calculator is an online tool that estimates your monthly loan payment based on loan amount, interest rate, and tenure. It helps you plan finances clearly before applying for a home loan.

Are EMI calculator results accurate in 2025?

Yes, they are highly accurate if you enter correct details. However, final EMIs may vary slightly due to processing fees, insurance, or changes in interest rates offered by the bank.

Can I use an EMI calculator to compare banks?

Absolutely. This is one of its biggest benefits. You can compare EMIs across banks by changing interest rates and tenures, helping you choose the most affordable option.