Imagine millions of central government employees and pensioners waking up to the brighter financial prospects, with the wheels of a grand salary restructuring turned. Loathe to inflation each passing year but for the promise of some relief and the reward for dedicated public service, the horizon that heralds the 8th Central Pay Commission should come to the longsuffering multitude in 2026 or soon after.

Formation of the Commission and Milestones

The government formally approved the constitution of the 8th Central Pay Commission in 2025. Important benchmarks in 2025 were Cabinet approval and the notification of the Terms of Reference on November 3.

In its composite crew, the 8th Pay Commission features a Chairperson, one part-time Member, and a Member-Secretary and shall finish its task within 18 months. In principle, the projected time of submission would fall in mid-2027.

Implementation Date

No official confirmation has yet been received in prospective implementation dates. While speaking in Parliament on December 8, 2025, Mr. Chaudhary, Minister of State for Finance, stated that the government would be renewing the same back after the commission report is concerned and, thereafter, allowing the required time regarding the actual implementation day.

From the beginning, for one pay commission to be the previous pay commission, it has occurred that the pay commission would commence on the day following the day for the cessation of the previously operating one. The 7th Pay Commission ends on December 31, 2025. Will it commence from January 1, 2026? It depends on the government to make its pronouncement.

Arrears and Backdating Prospects

One long-burning question is when the revised salaries and pensions can be paid: retroactively from January 1, 2026, thereby resulting in arrears?

Past commissions often provided backdated benefits. Recent parliamentary responses strongly indicate that the government will decide this after accepting recommendations.

But, there is nothing settled over arrears of 2026. Unions argue it for the sake of fairness.

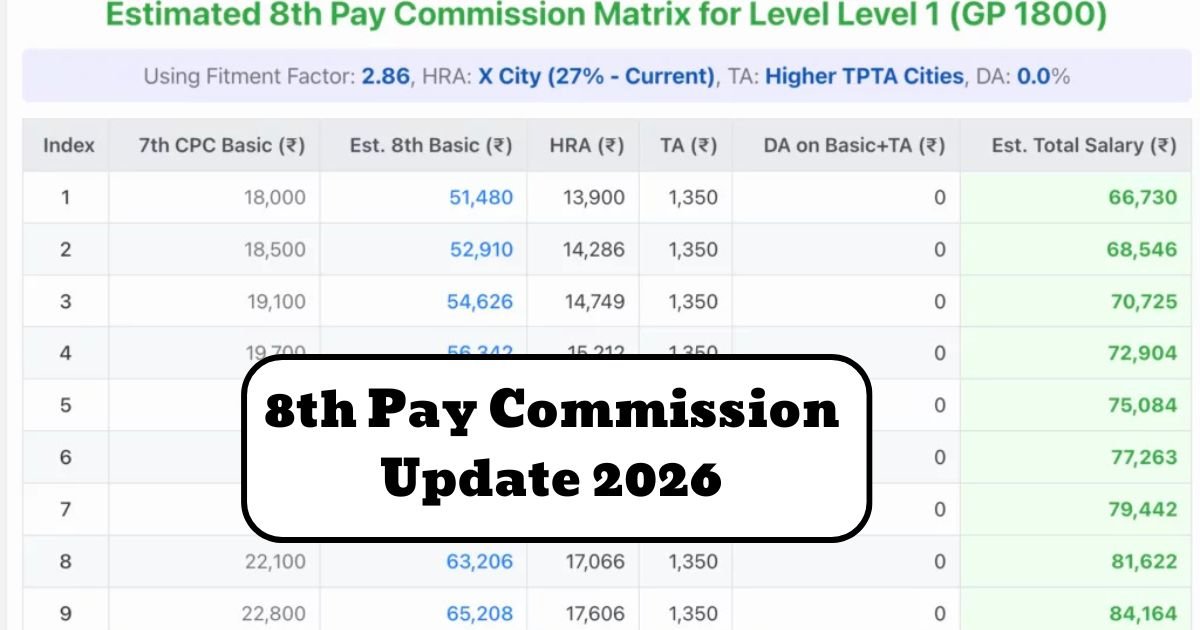

Expected Salary Hike and Fitment Factor

An enormous surge in prices is envisaged to offset inflation. Projections hint at a rise of close-to 30-34% overall.

The fitment factor, a multiplicative factor, may be in the range of 1.83 to 2.86. Some firmer unions have been advocating for new proposals for fitment up to and beyond 3.00 factor wise.

| Pay Commission | Fitment Factor | Minimum Basic Pay Increase Example |

|---|---|---|

| 6th | 1.86 | From ₹2,750 to ₹7,000 |

| 7th | 2.57 | From ₹7,000 to ₹18,000 |

| 8th (Expected) | 1.83-2.86 | From ₹18,000 to ₹33,000-₹51,000 |

Impact on Employees and Pensioners

At least 50 lakh central government employees and around 69 lakh pensioners, who act as key components thereof, will be impacted.

Pensions are connected to the pay structures, giving the resulting benefits concurrently. Other allowances such as House Rent Allowance or Travelling Allowance will get adjusted accordingly.

In Fiscal Management, it was announced by the government in the Statement of the Terms of reference that Fiscal Prudence is the basis.

What Lies Ahead

Though the setting up of the commission signifies the necessary measure, there would be little speaking in terms of the technical part: This commission, keeping in view earlier commissions’ orders, will frame its own methodology for the recommendations. More clarity is expected to come from the Union Budget of 2026-27.

Employees should continually search for information via modes that are official for updates. This may set the tone for compensation for the next whole decade.